Story from KARK: “Back to school” rarely meets the term “save money,” but that will change Aug. 6 weekend with the Arkansas Sales Tax Holiday.

The weekend, officially from 12:01 a.m. Aug. 6 to 11:59 p.m. Aug. 7, no state and local taxes are charged at the register on certain items. This also applies to online purchases made during this time frame.

- Clothing under $100

- Clothing accessories under $50

- Handbags, cosmetics, jewelry, umbrellas, all that, as long as it is under $50.

- School supplies

- This falls under the $50 accessory rule and extends to backpacks, paper, binders, notepaper, pencils, rulers, and items like this.

- Electronics

- Calculators, desktop computers, cell phones, e-readers, computer mice, laptops, monitors, printers, and more.

- Video game systems are NOT included in this category.

The Arkansas legislature provides a full list of tax-exempt items [pdf] for the weekend, as well as frequently asked questions [pdf] about it.

Arkansas legislature Act 757 put the sales tax holiday in place. An article of clothing for less than $100 will not be taxed during the weekend. No loopholes here, a $110 pair of jeans is taxed both state and local at its $110 value.

Total saving for the weekend for Arkansas back-to-school consumers is expected to reach $650,000.

Harrison Voters Split on Sales Tax Renewals, Other Election Results

Harrison Voters Split on Sales Tax Renewals, Other Election Results

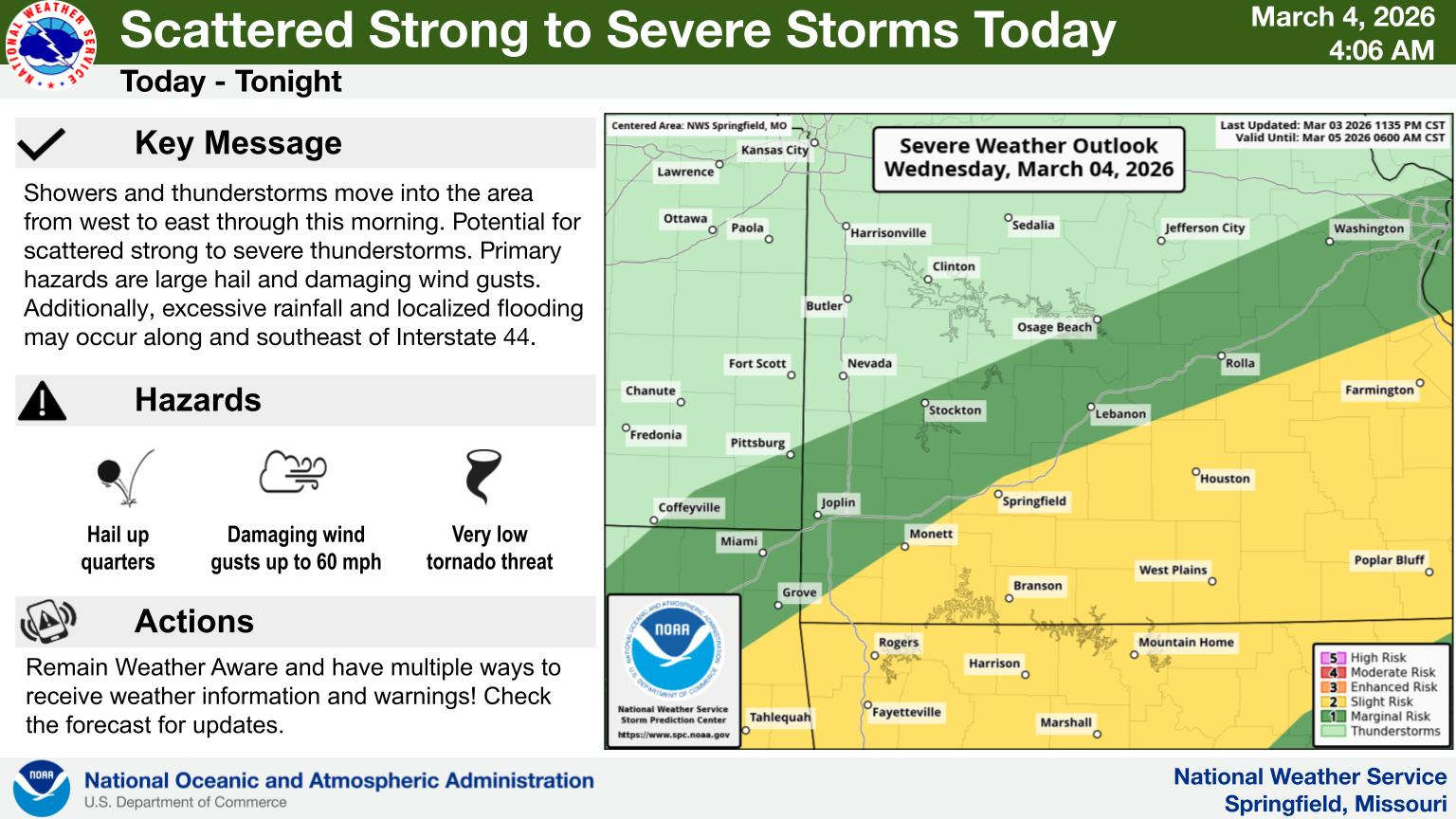

Severe Storms in Forecast for Today, Friday

Severe Storms in Forecast for Today, Friday

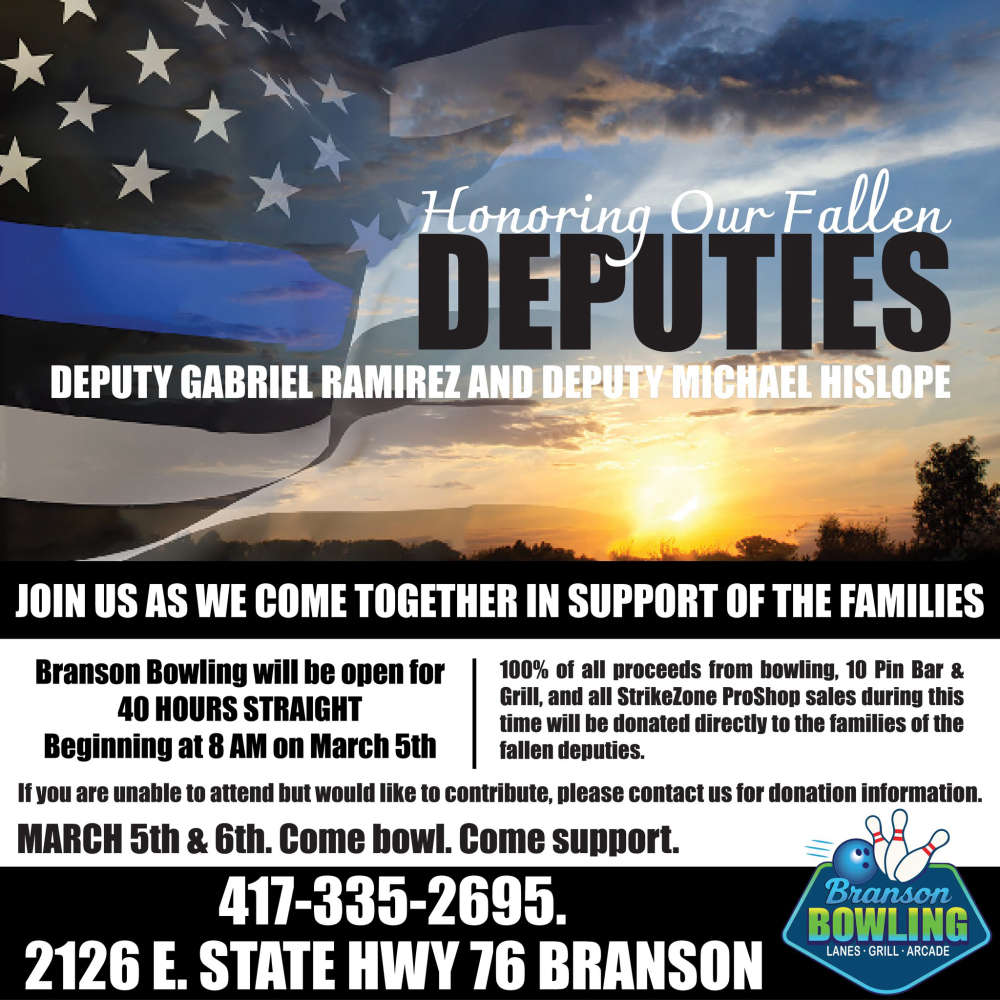

40 Hours of Bowling for Fallen Deputies

40 Hours of Bowling for Fallen Deputies

Branson Woman Facing Charges in Infant Death

Branson Woman Facing Charges in Infant Death

National Nutrition Month: "The Power of Nutrition"

National Nutrition Month: "The Power of Nutrition"

Comments

Add a comment