Arkansas Legislators have been busy during this week's Special Session in Little Rock.

According to recaps posted by KTLO, both the State’s House and Senate Revenue and Taxation committees have sent to their respective chambers bills that would slice the state’s top individual income tax rate from 4.4 percent to 3.9 percent and the state’s top corporate income tax rate from 4.8 percent to 4.3 percent, retroactive to January 1 this year.

The committees also passed proposals that would increasing the homestead property tax credit from $425 to $500.

If both bills pass the full House and Senate, they would go into effective retroactive to January 1 once signed by Governor Sarah Huckabee Sanders.

Meanwhile, Arkansas’s Joint Budget Committee has acted on another agenda item set for the special session. The committee approved an appropriation bill for the state Game and Fish Commission to raise the maximum authorized salary for the commission director to $170,000.

The Legislature failed to act on this during the regular session making the Arkansas Game and Fish Commission the only state department that did not have an approved budget for the new fiscal year set to begin on July 1.

The measure still needs full legislative approval and Governor Sanders' signature before being finalized.

Primary Election Day

Primary Election Day

Severe Weather Threat for Lakes Region Increases for Wednesday, Friday

Severe Weather Threat for Lakes Region Increases for Wednesday, Friday

Harrison Man Charged After Pursuit in Baxter County

Harrison Man Charged After Pursuit in Baxter County

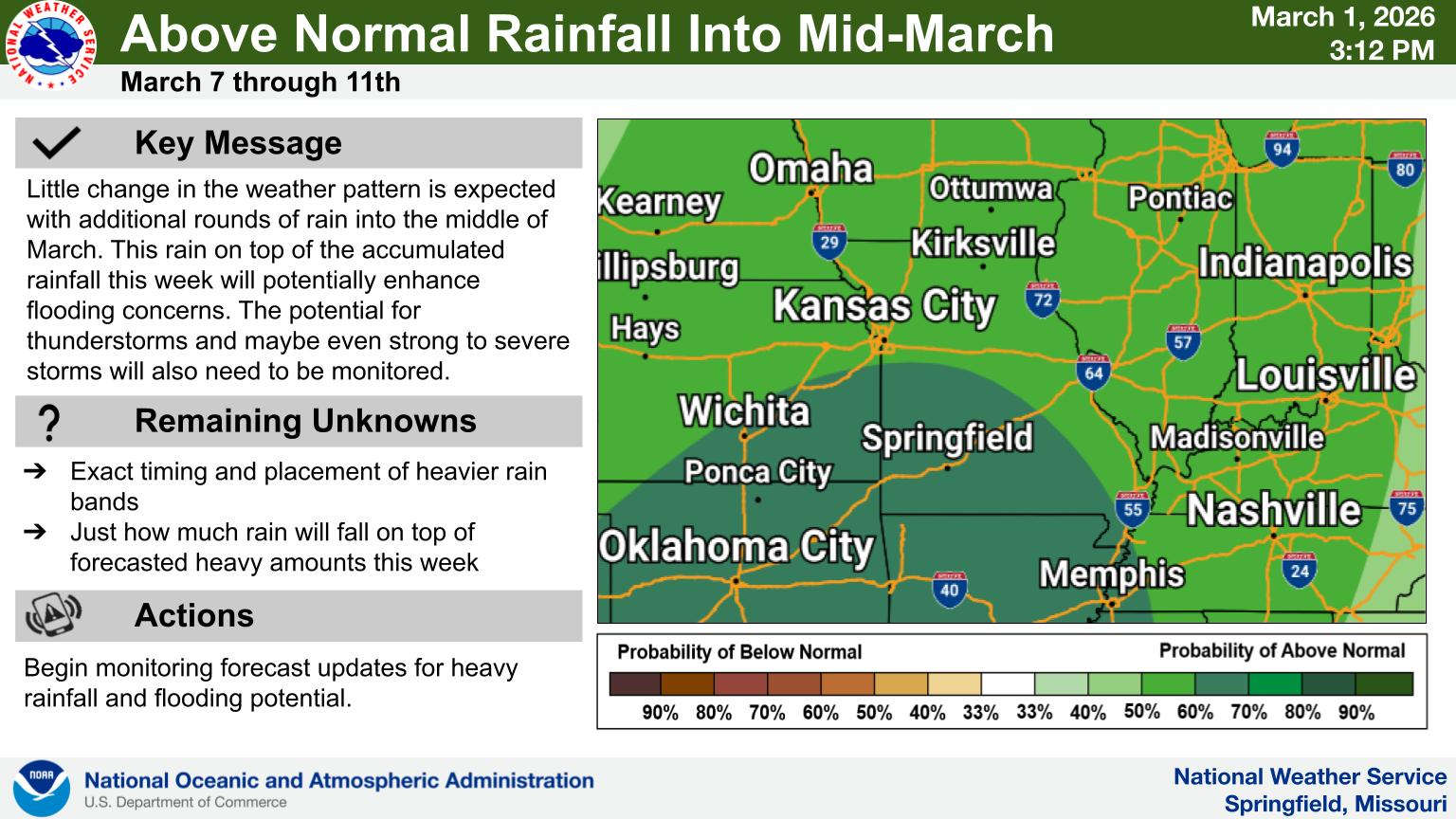

Rainy Pattern in Place, Severe Storms Possible Later This Week

Rainy Pattern in Place, Severe Storms Possible Later This Week

Early Voting Last Day, Primary Election Tuesday

Early Voting Last Day, Primary Election Tuesday